American Express has revolutionized the way cardholders experience dining through their exclusive Resy partnership and generous credits. However, navigating the differences between the Gold Card, Platinum Card, Delta Reserve, and Delta Platinum can feel overwhelming without the right guidance. Each card delivers distinct Resy credits and dining benefits, yet the true value depends entirely on your lifestyle and spending habits.

This comprehensive guide breaks down every nuance of Amex Resy credits across four powerhouse cards, revealing which option delivers maximum value for your dining dollars. Whether you’re a frequent restaurant explorer, a business entertainer, or a casual diner, understanding these credit structures transforms how you approach luxury spending. We’ll cut through the complexity and show you exactly which card aligns with your needs, helping you maximize every benefit and eliminate wasted potential.

Understanding American Express Resy Credits: The Foundation

Resy is OpenTable’s premium dining platform, and American Express cardholders receive exclusive benefits through strategic partnerships. These Resy credits represent real money back toward your dining experiences, but they operate differently across card tiers. Rather than receiving flat cash rewards, you get predetermined annual credits specifically designated for Resy reservations.

The value proposition is compelling. Top-tier American Express cards offer substantial annual credits that, when fully utilized, can offset significant portions of annual fees. However, the pathway to maximizing these credits requires understanding exactly what each card provides and how the crediting mechanism actually works in real-world scenarios.

Amex Gold Card: The Dining Enthusiast’s Entry Point

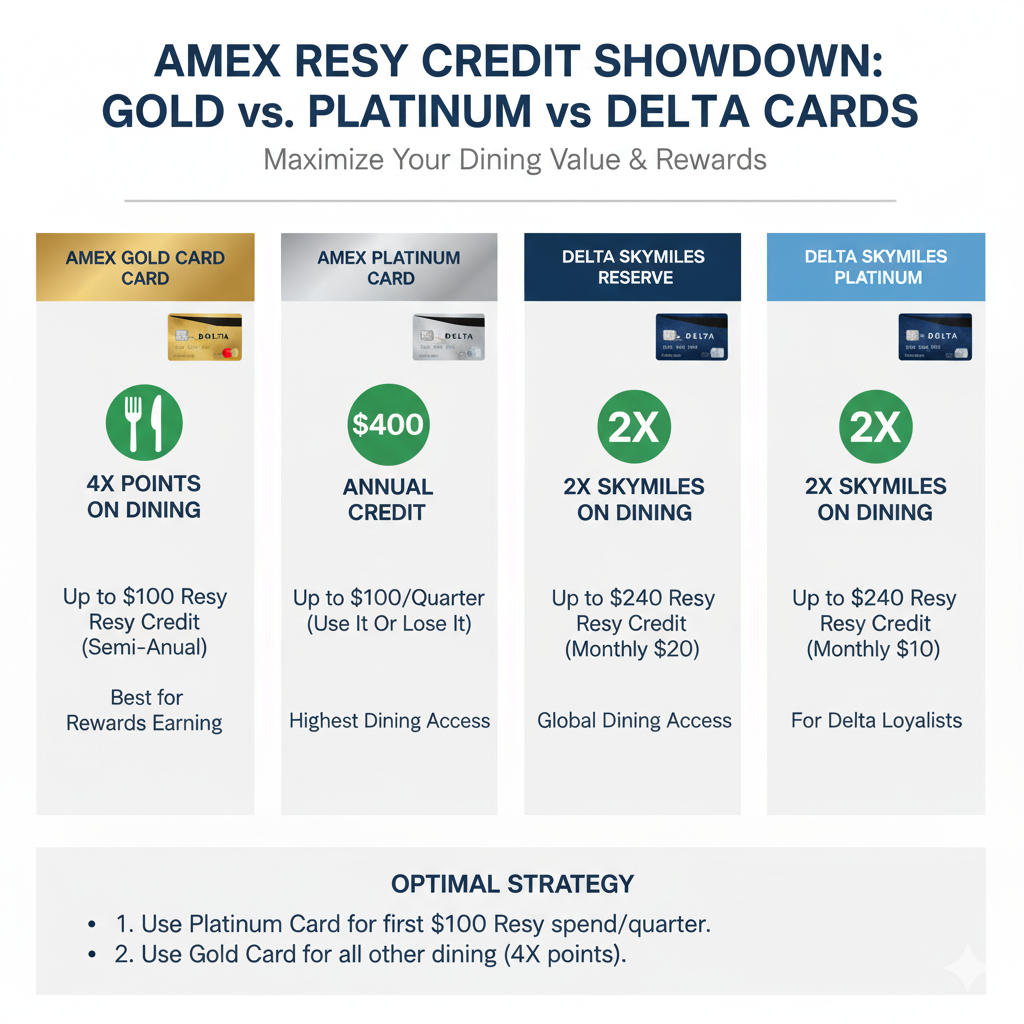

The Amex Gold Card positions itself as the perfect entry into premium dining benefits without the premium pricing of ultra-luxury cards. This card delivers a $120 annual Resy dining credit that applies directly to restaurant charges made through Resy reservations.

The Gold Card excels for diners who maintain moderate to high restaurant spending but haven’t yet committed to the Platinum tier. The credit applies automatically once you charge your Resy meal to the card, with no complicated redemption process required. Additionally, the Gold Card provides 4x points per dollar on eligible dining purchases at restaurants worldwide, amplifying the value beyond the raw credit itself.

What makes the Gold Card particularly strategic is its $250 annual fee paired against meaningful benefits. The annual Resy credit alone recovers nearly half of the fee, while 4x points on dining spending generate substantial additional value. Restaurant exploration becomes economically efficient, as every dollar spent yields both rewards points and valuable purchasing power.

However, the $120 Resy credit carries limitations. Cardholders must actively use this benefit monthly to maximize value—roughly $10 per month requires conscious effort and planning. Many Gold cardholders find themselves leaving credits on the table simply due to lifestyle misalignment or failure to maximize dining occasions.

Amex Platinum Card: The Premium Entertainment Platform

The Amex Platinum Card elevates the Resy experience dramatically with a $200 annual Resy dining credit, effectively doubling the Gold Card benefit. This positions Platinum as the preferred option for serious diners, business entertainers, and frequent travelers who leverage dining as a central lifestyle component.

Beyond the raw credit amount, Platinum cardholders receive the renowned Amex Platinum concierge service, which actively assists with securing difficult reservations at coveted restaurants. This service transforms Resy credits into access—many members report successfully booking tables at restaurants with months-long waiting lists through dedicated concierge support.

The Platinum experience also extends beyond Resy. Members receive exclusive fine dining access through additional benefits, including the 1-800 Flowers dining program and various restaurant partnerships. The $695 annual fee, while substantial, becomes justified through the cumulative benefit package when fully leveraged.

Platinum also offers 5x points on flights purchased directly from airlines and 5x points on hotels booked through the Amex platform. These benefits compound with the Resy credit, creating an ecosystem where travel and dining rewards work synergistically. Frequent business travelers and entertainment-focused professionals find Platinum indispensable for maximizing hospitality benefits.

Yet acquiring and consistently utilizing a $200 annual credit still requires intentional behavior. Premium dining experiences at top-tier restaurants frequently exceed this credit amount, meaning cardholders supplement with personal funds while still recapturing value through points multipliers.

Delta Reserve vs. Delta Platinum: The Airline Integration Advantage

American Express co-branded Delta cards merge airline benefits with Resy dining credits, creating a hybrid value proposition that appeals to frequent Delta flyers combining travel and dining experiences.

The Delta Reserve Card represents American Express’s most premium airline offering, featuring a $200 annual Resy dining credit alongside aggressive travel benefits. The card delivers a $550 annual fee supported by a $200 airline fee credit and a 10,000 SkyMiles bonus after you spend $3,000 in the first three months. The Resy credit effectively reduces the net annual fee to $350, making the travel benefits increasingly valuable.

Delta Reserve cardholders receive elite status benefits through SkyMiles, including priority boarding, baggage allowances, and seat selection advantages. These perks compound over time, as benefits accumulate across multiple flights annually, multiplying the total value delivered.

The Delta Platinum Card positions itself as an accessible Delta co-brand option with a $250 annual fee and a $100 annual Resy dining credit. While the credit amount lags behind Reserve and Platinum, the lower fee creates a more achievable entry point for Delta-focused travelers with moderate spending patterns.

Delta Platinum cardholders receive SkyMiles earning at 2 miles per dollar on all Delta purchases and 1 mile per dollar on all other purchases. This accelerated earning structure means frequent Delta travelers accumulate elite status qualifying miles more rapidly, potentially unlocking premium perks without maintaining elite credit card status elsewhere.

The strategic choice between Delta cards depends entirely on annual Delta spending and dining patterns. Heavy Delta travelers with substantial airline spend justify Delta Reserve, while casual Delta flyers maximize value through Delta Platinum’s lower annual fee and simpler benefit structure.

Head-to-Head Comparison: Which Card Delivers Maximum Value?

Selecting the optimal American Express card requires matching your financial profile against each card’s specific benefits. Let’s examine practical scenarios.

For Frequent Restaurant Explorers: The Amex Platinum Card emerges as the victor. The $200 annual Resy credit combined with 5x points on flights and premium dining ecosystem access justifies the $695 annual fee for professionals who entertain clients or frequently dine at fine establishments.

For Moderate Diners: The Amex Gold Card provides superior value. The $120 Resy credit, 4x points on restaurant spending, and lower $250 annual fee create an economically efficient option. Gold also delivers 3x points on streaming services and $100 annual credits at certain retailers, providing diversified value.

For Frequent Delta Flyers: The Delta Reserve Card becomes essential if you spend over $15,000 annually on Delta flights and maintain consistent fine dining habits. The combination of SkyMiles elite benefits and $200 Resy credits creates compounding value. However, if Delta spending remains under $12,000 annually, Delta Platinum offers superior economics.

For Budget-Conscious Airline Travelers: Delta Platinum delivers the best entry-level option. The lower fee, $100 Resy credit, and accelerated SkyMiles earning create straightforward value for Delta-focused travelers building elite status.

Maximizing Your Resy Credit: Actionable Strategies

Understanding which card to choose represents only half the equation. Actually maximizing your Resy credit requires intentional planning and behavioral modification.

First, establish recurring monthly dining occasions. Rather than viewing Resy as a “special occasion” platform, integrate regular restaurant visits into your monthly routine. This behavioral anchor ensures consistent Resy usage and prevents credit forfeiture.

Second, leverage the Amex concierge service, particularly if you hold Platinum. Concierge representatives possess insider knowledge regarding restaurant availability and can secure reservations that standard Resy bookings cannot. This transforms credits into access at impossible-to-book establishments.

Third, coordinate Resy usage with business entertainment needs. Combining personal dining with client entertainment maximizes benefit realization while building business relationships. Premium restaurants through Resy platforms project professionalism and strengthen client connections.

Fourth, monitor promotional dining periods. Certain restaurants offer accelerated point earning or special promotions during specific seasons. Timing your Resy visits strategically amplifies total rewards earned beyond the base credit itself.

Finally, stack benefits across multiple reward programs. Many premium restaurants participate in both Resy and alternative loyalty programs. Paying through Amex while accruing restaurant loyalty points creates multiplicative value across ecosystems.

American Express Resy credits represent powerful tools for transforming dining experiences into rewarding financial benefits. The Gold Card serves budget-conscious enthusiasts, Platinum elevates serious diners with premium access, and Delta cards integrate airline loyalty with dining rewards for frequent travelers.

The optimal selection depends on your annual restaurant spending, travel patterns, and willingness to actively engage with premium dining platforms. Gold provides accessible entry with meaningful benefits, Platinum justifies premium positioning through comprehensive value delivery, and Delta cards solve specific loyalty needs for airline-focused professionals.

Rather than viewing annual fees as expenses, successful cardholders recognize them as investments in lifestyle enhancement. By strategically selecting the appropriate card and actively utilizing all available credits, you transform dining into an economically efficient component of your premium lifestyle while building meaningful rewards across multiple benefit categories.

Your perfect American Express Resy card exists within this lineup. The question remains: which one aligns with your unique financial profile and dining ambitions?