Are you tired of feeling like just another account number at a big, impersonal bank? Do you wish your financial institution truly understood the local landscape and invested back into the community you call home? Discover the local difference right here in Antigo, Wisconsin. While larger banks often prioritize distant shareholders, CoVantage Credit Union Antigo WI operates with a singular focus: you, its member-owner.

Understanding the CoVantage Difference: Credit Union vs. Bank

Many people use “bank” and “credit union” interchangeably, but at their core, these institutions operate on fundamentally different principles. Understanding these differences is the first step to appreciating the unique value CoVantage Credit Union Antigo WI brings to its members.

What Exactly Is a Credit Union? (The “People Helping People” Model)

A credit union is a non-profit financial cooperative owned and controlled by its members. Unlike traditional banks, which are typically for-profit entities accountable to external shareholders, credit unions like CoVantage exist solely to serve their members. This “people helping people” philosophy translates into tangible benefits:

- Member-Owned: When you open an account at CoVantage, you become a part-owner. This democratic structure means any profits are returned to members in the form of lower loan rates, higher savings dividends, and reduced fees.

- Local Focus: Decisions are often made locally, allowing CoVantage to better understand and respond to the specific financial needs of the Antigo community.

- Community Reinvestment: Surplus earnings are channeled back into the credit union to enhance services, technology, and support local initiatives through programs like the CoVantage Cares Foundation.

CoVantage Membership Eligibility for Antigo Residents

One common misconception is that credit unions are exclusive. For CoVantage Credit Union Antigo WI, membership is designed to be accessible to a broad segment of the community. Generally, eligibility is tied to where you live, work, worship, or attend school.

For those residing in Antigo, WI, and the broader Langlade County area, meeting the membership criteria is typically straightforward. If you live or work in the eligible counties served by CoVantage, you can become a member. The process is simple:

- Verify Eligibility: A quick check on the CoVantage website or a call to one of the Antigo branches will confirm your eligibility.

- Open a Share Savings Account: This typically involves a small initial deposit (often $5-$25) which represents your “share” and officially makes you a member-owner.

- Start Banking: Once your share account is open, you gain access to all the services and benefits CoVantage offers.

Core Financial Services for Antigo Families and Individuals

As a member-owner of CoVantage Credit Union Antigo WI, you’ll find a comprehensive suite of financial products and services designed to meet your everyday needs and long-term goals.

Maximizing Your Savings and Checking Accounts

CoVantage understands that your money should work for you, not the other way around. Their account offerings reflect this philosophy:

- Fee-Free Checking Accounts: Many options come with no monthly service fees, no minimum balance requirements, and convenient features like online bill pay and mobile check deposit. This is a direct benefit of the credit union model – less money spent on fees means more in your pocket.

- Competitive Savings & Investment Accounts: Whether you’re saving for a rainy day, a down payment, or retirement, CoVantage offers various options, including traditional savings accounts, high-yield Money Market accounts, and Certificates of Deposit (CDs) with competitive dividend rates. They also offer Individual Retirement Accounts (IRAs) to help you plan for the future.

- Modern Digital Tools: Managing your money is seamless with the CoVantage mobile app, online banking platform, and digital wallet capabilities. You can easily check balances, transfer funds, pay bills, and set up alerts from anywhere.

Local Loans with Lower Rates in Langlade County

When it comes to borrowing, CoVantage Credit Union Antigo WI aims to provide competitive rates and flexible terms that benefit you, the member. Their lending solutions are tailored to the local market and your specific needs:

- Auto Loans: Whether you’re buying new or used, CoVantage offers competitive auto loan rates with flexible payment plans. Plus, with local loan officers, the pre-approval and application process is often streamlined and personalized.

- Personal Loans and Lines of Credit: Need funds for an emergency, home improvement, or debt consolidation? CoVantage provides personal loans and lines of credit with clear terms, helping you manage unexpected expenses or larger purchases without high-interest credit card debt.

- Mortgage Loans: For many Antigo families, their home is their largest asset. CoVantage offers a variety of mortgage loan programs, including options for first-time homebuyers, conventional mortgages, and refinancing services, all handled by experienced local lenders who understand the Antigo housing market. Their focus on member value often translates into lower interest rates and fees compared to some traditional lenders. For transparent and competitive CoVantage Antigo loan rates, it’s always best to speak directly with their mortgage specialists.

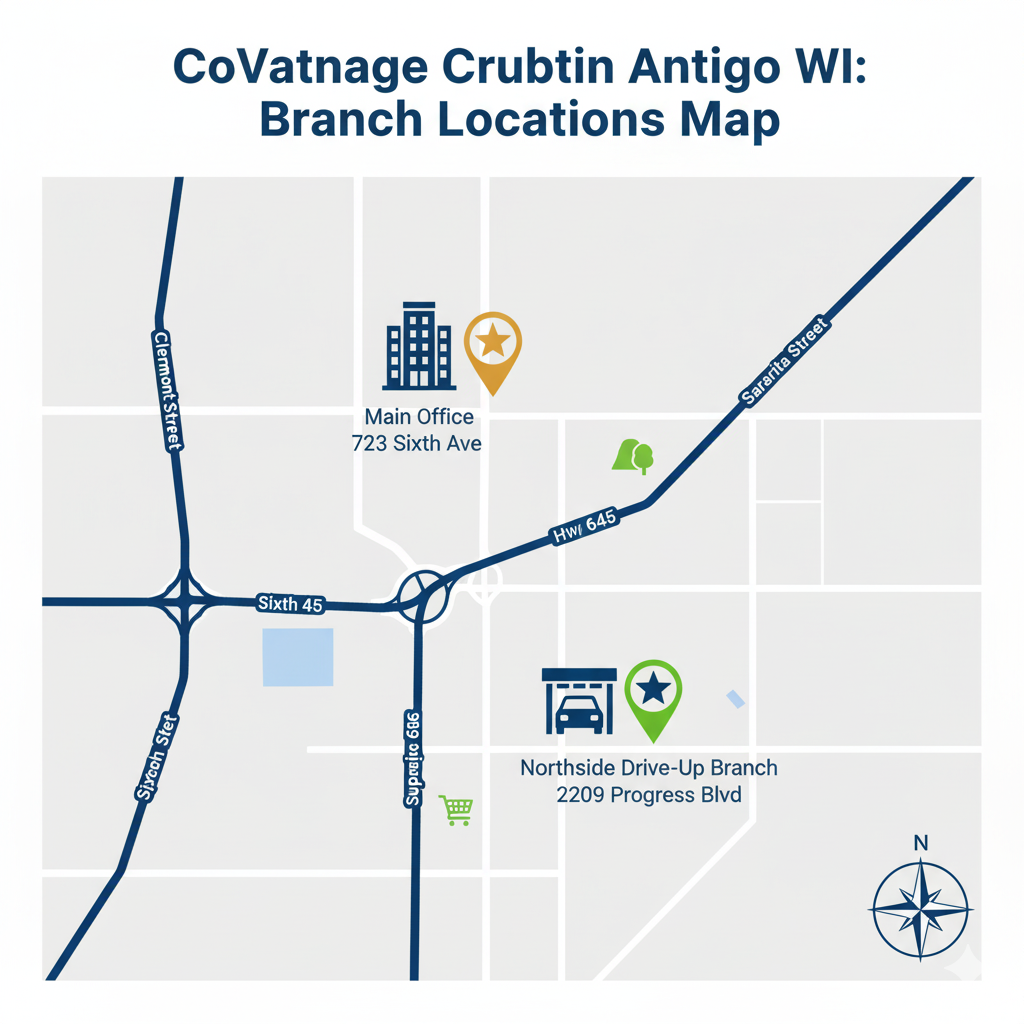

Your Home Base: The CoVantage Credit Union Antigo WI Locations

One of the greatest advantages of banking with CoVantage Credit Union Antigo WI is the accessibility and convenience of their local branches. You’re not just calling a distant corporate number; you have real people in your community ready to assist you.

Main Office vs. Drive-Up Branch: Hours and Accessibility

CoVantage serves the Antigo community through two convenient locations, ensuring that whether you prefer in-person service or quick transactions, your needs are met:

- Main Office (723 Sixth Ave, Antigo, WI 54409): This full-service branch offers comprehensive banking solutions, including new account opening, loan applications, financial planning appointments, and teller services. It’s ideal for in-depth conversations and personalized assistance.

- Northside Drive-Up Branch (2209 Progress Blvd, Antigo, WI 54409): Designed for speed and efficiency, this branch focuses on drive-up teller services, making it perfect for quick deposits, withdrawals, and loan payments without having to leave your car. It complements the main office by providing additional convenience for busy members.

Both locations operate with member-friendly hours and are equipped with Virtual Teller ATMs, offering extended service hours beyond traditional lobby times. Plus, as a CoVantage member, you have access to a vast network of surcharge-free ATMs nationwide (CO-OP Network), so your money is always within reach.

CoVantage Credit Union Antigo WI: Your Local Guide to Member-Owned Banking & Value

Are you tired of feeling like just another account number at a big, impersonal bank? Do you wish your financial institution truly understood the local landscape and invested back into the community you call home? Discover the local difference right here in Antigo, Wisconsin. While larger banks often prioritize distant shareholders, CoVantage Credit Union Antigo WI operates with a singular focus: you, its member-owner.

This comprehensive guide breaks down exactly what CoVantage Credit Union Antigo WI offers: from higher returns on your savings and competitive loan rates to its deep, unwavering commitment to the Langlade County community. We’ll cut through the jargon, explain the unique credit union model, and highlight the tangible benefits of local banking. Read on to learn the simple membership requirements, explore the array of key services designed for your financial well-being, and see how joining CoVantage truly makes you a member-owner, not just a customer. Get ready to transform your banking experience and discover the powerful advantages of having a financial partner right in your neighborhood.

Understanding the CoVantage Difference: Credit Union vs. Bank

Many people use “bank” and “credit union” interchangeably, but at their core, these institutions operate on fundamentally different principles. Understanding these differences is the first step to appreciating the unique value CoVantage Credit Union Antigo WI brings to its members.

What Exactly Is a Credit Union? (The “People Helping People” Model)

A credit union is a non-profit financial cooperative owned and controlled by its members. Unlike traditional banks, which are typically for-profit entities accountable to external shareholders, credit unions like CoVantage exist solely to serve their members. This “people helping people” philosophy translates into tangible benefits:

- Member-Owned: When you open an account at CoVantage, you become a part-owner. This democratic structure means any profits are returned to members in the form of lower loan rates, higher savings dividends, and reduced fees.

- Local Focus: Decisions are often made locally, allowing CoVantage to better understand and respond to the specific financial needs of the Antigo community.

- Community Reinvestment: Surplus earnings are channeled back into the credit union to enhance services, technology, and support local initiatives through programs like the CoVantage Cares Foundation.

CoVantage Membership Eligibility for Antigo Residents

One common misconception is that credit unions are exclusive. For CoVantage Credit Union Antigo WI, membership is designed to be accessible to a broad segment of the community. Generally, eligibility is tied to where you live, work, worship, or attend school.

For those residing in Antigo, WI, and the broader Langlade County area, meeting the membership criteria is typically straightforward. If you live or work in the eligible counties served by CoVantage, you can become a member. The process is simple:

- Verify Eligibility: A quick check on the CoVantage website or a call to one of the Antigo branches will confirm your eligibility.

- Open a Share Savings Account: This typically involves a small initial deposit (often $5-$25) which represents your “share” and officially makes you a member-owner.

- Start Banking: Once your share account is open, you gain access to all the services and benefits CoVantage offers.

| Feature | Traditional Bank | CoVantage Credit Union |

| Ownership | For-profit, owned by external shareholders | Not-for-profit, owned by its members |

| Mission | Maximize shareholder profits | Serve members’ financial needs & community |

| Fees | Often higher and more prevalent | Generally lower, fewer, or waived |

| Loan Rates | Can be higher to boost profits | Typically lower due to member focus |

| Savings Rates | Can be lower | Often higher (dividends paid back to members) |

| Decision-Making | Corporate, often distant | Local, member-focused |

Core Financial Services for Antigo Families and Individuals

As a member-owner of CoVantage Credit Union Antigo WI, you’ll find a comprehensive suite of financial products and services designed to meet your everyday needs and long-term goals.

Maximizing Your Savings and Checking Accounts

CoVantage understands that your money should work for you, not the other way around. Their account offerings reflect this philosophy:

- Fee-Free Checking Accounts: Many options come with no monthly service fees, no minimum balance requirements, and convenient features like online bill pay and mobile check deposit. This is a direct benefit of the credit union model – less money spent on fees means more in your pocket.

- Competitive Savings & Investment Accounts: Whether you’re saving for a rainy day, a down payment, or retirement, CoVantage offers various options, including traditional savings accounts, high-yield Money Market accounts, and Certificates of Deposit (CDs) with competitive dividend rates. They also offer Individual Retirement Accounts (IRAs) to help you plan for the future.

- Modern Digital Tools: Managing your money is seamless with the CoVantage mobile app, online banking platform, and digital wallet capabilities. You can easily check balances, transfer funds, pay bills, and set up alerts from anywhere.

Local Loans with Lower Rates in Langlade County

When it comes to borrowing, CoVantage Credit Union Antigo WI aims to provide competitive rates and flexible terms that benefit you, the member. Their lending solutions are tailored to the local market and your specific needs:

- Personal Loans and Lines of Credit: Need funds for an emergency, home improvement, or debt consolidation? CoVantage provides personal loans and lines of credit with clear terms, helping you manage unexpected expenses or larger purchases without high-interest credit card debt.

- Auto Loans: Whether you’re buying new or used, CoVantage offers competitive auto loan rates with flexible payment plans. Plus, with local loan officers, the pre-approval and application process is often streamlined and personalized.

- Mortgage Loans: For many Antigo families, their home is their largest asset. CoVantage offers a variety of mortgage loan programs, including options for first-time homebuyers, conventional mortgages, and refinancing services, all handled by experienced local lenders who understand the Antigo housing market. Their focus on member value often translates into lower interest rates and fees compared to some traditional lenders. For transparent and competitive CoVantage Antigo loan rates, it’s always best to speak directly with their mortgage specialists.

Your Home Base: The CoVantage Credit Union Antigo WI Locations

One of the greatest advantages of banking with CoVantage Credit Union Antigo WI is the accessibility and convenience of their local branches. You’re not just calling a distant corporate number; you have real people in your community ready to assist you.

Main Office vs. Drive-Up Branch: Hours and Accessibility

CoVantage serves the Antigo community through two convenient locations, ensuring that whether you prefer in-person service or quick transactions, your needs are met:

- Main Office (723 Sixth Ave, Antigo, WI 54409): This full-service branch offers comprehensive banking solutions, including new account opening, loan applications, financial planning appointments, and teller services. It’s ideal for in-depth conversations and personalized assistance.

- Northside Drive-Up Branch (2209 Progress Blvd, Antigo, WI 54409): Designed for speed and efficiency, this branch focuses on drive-up teller services, making it perfect for quick deposits, withdrawals, and loan payments without having to leave your car. It complements the main office by providing additional convenience for busy members.

Both locations operate with member-friendly hours and are equipped with Virtual Teller ATMs, offering extended service hours beyond traditional lobby times. Plus, as a CoVantage member, you have access to a vast network of surcharge-free ATMs nationwide (CO-OP Network), so your money is always within reach.